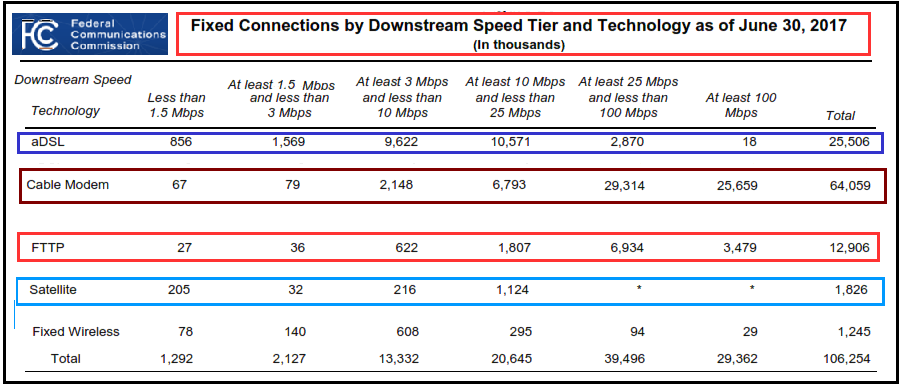

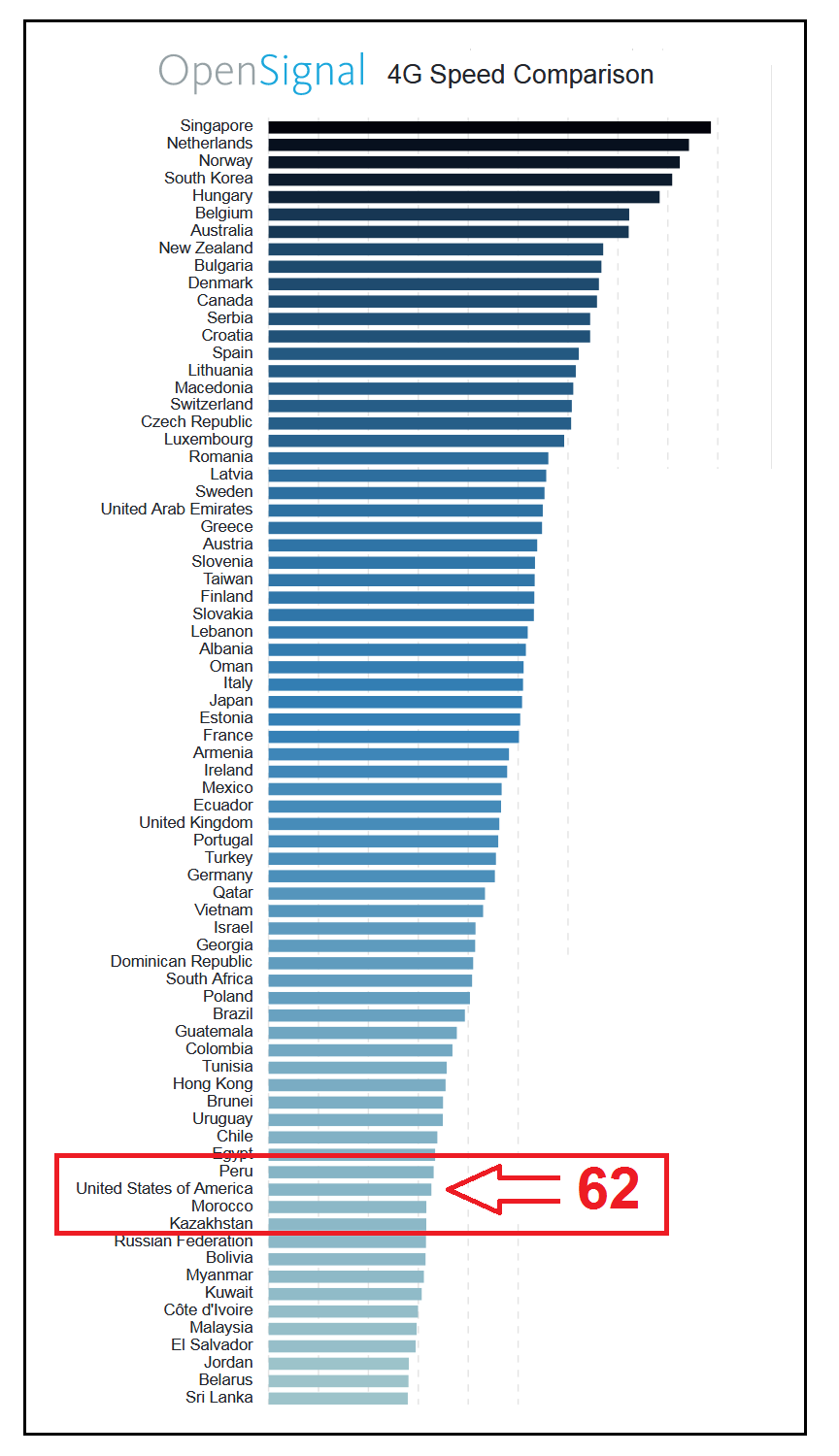

OpenSignalAmerica62

Verizon NY in Multi-Billion Dollar Settlement Tangle, Underway in New York State | HuffPost

Primernetworks

Verizonytimeline

NYstatebroadbandanswers

Good morning Mr. Kushnick,

Responses to your questions are posted below your original questions, and will be posted on the CIO/OFT website as well.

Have a great day!

Chad Smith

Contract Management Specialist

CIO/OFT Division of Telecommunications

This e-mail, including any attachments, may be confidential, privileged or otherwise legally protected. It is intended only for the addressee. If you received this e-mail in error or from someone who was not authorized to send it to you, do not disseminate, copy or otherwise use this e-mail or its attachments. Please notify the sender immediately by reply e-mail and delete the e-mail from your system.

From: Bruce Kushnick [mailto:[email protected]]

Sent: Thursday, January 17, 2008 3:31 AM

To: oft.sm.counsel.cpo

Subject: questions for the broadband grant

NOTE: We provide this email as well as submitted the questions in a word document. “THE BROADBAND OPPORTUNITY PLAN FOR NEW YORK STATE”

Submitted by Bruce Kushnick, New Networks Institute and Teletruth, on behalf of the Open Infrastructure Alliance. (OIA)

CONTACT: Bruce Kushnick, [email protected] 718-238-7191

Questions for New York State:

Open Infrastructure Alliance (OIA), is a group of some of America’s leading experts in broadband, Internet, wireless, as well as regulatory, legal and implementation issues. Will be proposing a practical, real world, multifaceted research and implementation plan to fund, without raising new taxes or even matching funds, the state’s stated goal — to deploy to ALL New York state citizens and businesses 100 mbps services to urban areas, (potentially 1 gigabit) and 20 mbps in rural areas (or higher), not to mention underserved areas, by 2015. These services would be open to all competitors. We are also proposing to create in New York State new areas of economic development using the Governor’s broadband initiative.

We have 2 sets of questions:

- The establishment of baseline requirements and the information currently available through the state.

- Issues surrounding the state’s RFP as a research and implementation grant and our requirements to fulfill the state’s RFP requirements.

Baseline Requirements and Rational for Data Development:

The actual cost of deploying 100 mbps services (or higher) to the entire state will be $10-$20 billion dollars. This requires not only changes to existing laws, but a large amount of data to be created as a ‘baseline’ as to what is and is not available today, what are customers currently paying, the actual costs to offer services, not to mention the current plant and location of the wiring, etc.

Broadband is currently (and in the future) not sold as a standalone product but includes at least 5 different product areas — Local, long distance, connection to the Internet (ISP), broadband-DSL (faster pipe), and cable/video services, each with their own cost models, usage, suppliers, etc. A strong business model requires an understanding of both the user side as well as the cost of offering these services, not to mention the requirements of the current infrastructure as well as upgrading existing plant, and regulatory and legal issues surrounding the current infrastructure and use as starting points

- Customer information: This information should provide not only what the current costs to customers are, and who is using the service, (or does not have service), as well as current competition levels for broadband and all related services.

- Network and plant information: What current networks are available today, including their location and capabilities?

- Cost of service issues: How much do these services cost to provide today?

- What are the current regulatory and legal starting points?

CIO/OFT Response: This response is applicable to the questions you have asked regarding the telephone (local exchange) companies and the franchised cable television companies currently operating in New York State. The CIO/OFT does not have this information at the present time and we are beginning to work with the incumbent service providers to voluntarily provide this data. We also want to better understand their pricing models and service delivery costs…as well as what they consider to be impediments insofar as expanding their footprints and opening their facilities to third-party providers. With the exception of the latter, this information is proprietary and the CIO/OFT is developing the necessary safeguards to ensure each service provider’s information is protected from their competitors so they are comfortable sharing the data with us. The CIO/OFT will develop a provider-neutral map of NYS identifying where broadband gaps currently exist. We recognize the difference between accessibility and affordability…and plan to identify solutions to both problems.

Does the state have the following information, or should OIA create separate grants to create this data?

- Phone Company Requirements:

(We note that the phone companies’ regulatory, technology deployments, customer services, have different treatment than cable companies.)

1) Technical: Wiring and Plant.

Does the state have a map of all current incumbent wiring plans, including

- a) All fiber optic wiring, including all dark fiber (not in use) and lit fiber.

- b) All copper wiring plant both in use and not in use

- c) All switching, central office equipment and network layouts.

- d) All planned upgrades of the plant through 2015.

- e) All installations of all lines capable of ISDN, Special Access, DSL, broadband,

2) Customer side (by carrier)

The price and usage by customers of

- a) Local service

- b) long distance

- c) DSL

- d) broadband

- e) connectivity to the internet (ISP)

- f) wireless services

- g) Custopak and business services

- h) Triple play or bundles

- i) Video services, cable services.

3) Cost models

The costs to offer local phone service (business and residential.) including

- a) the costs of the maintaining the current plant

- b) the depreciation schedules for the plant,

- c) the costs spent on upgrades of the copper plant over the last 5 years

- d) the costs of the upgraded plant being used by FiOS

- e) the cost of all switching upgrades over the last decade.

- f) Audits of “Continuing Property Records: The state started on an audit of the actual equipment in the plant and found $634 million in missing equipment, impacting both rates as well as taxes paid. This was only ¼ of the audits required. Did the state continue these audits?

- Cable Company Requirements:

(We note that the cable companies’ regulatory, technology deployments, customer services, have different treatment than phone companies.)

1) Technical: Wiring and Plant.

Does the state have a map of all current incumbent wiring plans, including

- a) All fiber optic wiring, including all dark fiber (not in use) and lit fiber.

- b) All copper wiring plant both in use and not in use

- c) All switching, central office equipment and network layouts.

- d) All planned upgrades of the plant through 2015.

- e) All installations of all lines capable of ISDN, Special Access, DSL, broadband,

2) Customer Side (by carrier)

The price and usage by customers of:

- f) Local service

- g) long distance

- h) DSL

- i) broadband

- j) connectivity to the internet (ISP)

- k) wireless services

- l) business services

- m) Triple play or bundles.

3) Cost Models

the costs to offer local phone service (business and residential.) including

- a) the costs of the maintaining the current plant,

- b) the depreciation schedules for the plant,

- c) the costs spent on upgrades of the plant over the last 5 years

- d) the costs of the upgraded plant being used by the cable companies

- e) the cost of all video and telephone switching upgrades over the last decade.

Legal and Regulatory Baselines.

- a) A list of all pertinent cable and telephone regulatory and legal decisions needs to be compiled to be mapped to the projected future plan.

FILING REQUIREMENTS:

Part ONE:

- How many potential bidders did NYS include on its initial distribution of this RFP?

CIO/OFT Response: We cannot answer your question because the Broadband Grant Program RFP was not released via a “distribution list.” It was announced in a press release/press conference by Governor Spitzer on December 6. The RFP was also advertised in the NYS Contract Reporter (beginning on December 10). Both announcements directed interested parties to our website (www.oft.state.ny.us) from which the RFP could be downloaded or the interested parties could request that a copy of the RFP be mailed to them by contacting our office. The RFP has been publicly available since Friday, December 7, 2007.

- How many have since been added or deleted from the list?

CIO/OFT Response: This is not applicable…as explained above.

- Please provide a complete list of all potential bidders and indicate which are considered eligible for special credits (Minority, Woman Owned, SBA, etc.).

CIO/OFT Response: This is not applicable…as explained above.

- Is partnering with other potential bidders permitted? If so, what special measures or guidelines are prescribed by the State?

CIO/OFT Response: Partnering is highly encouraged! There are requirements in the RFP that could make it difficult for a single applicant to be successful. Where these elements are beyond one organizations core strengths, they are being encouraged to partner with others in order to submit a comprehensive proposal. There are no special measures or guidelines beyond what is stated in the RFP.

- Will these questions be emailed to the entire list of bidders?

CIO/OFT Response: We have committed to responding to each individual/organization submitting a question or concern during the open Question and Answer period (which closed on 1/17) by January 24, 2008. All questions and responses are being stripped of any identifying language and a generic version of the question and response are being posted on our website to benefit all potential applicants. Many questions and answers have already been posted. Please visit our website (www.oft.state.ny.us) and click on the Universal Broadband Q&A link on our “Hot News!” banner in the middle of our home page.

- Has any organization been pre-selected to receive funds and if so, who and how much.

CIO/OFT Response: No! This is a competitive process.

Part TWO: Our Proposal and the GRANT

“The Broadband Opportunity Plan” (working outline.) — OIA, using a team of experts, will be presenting a proposal that outlines a multi-faceted, robust plan that could fund New York state’s goal to deliver at least 100 mbps (more likely 1 gigabit) services to ALL New York state residents and businesses, (lower speed in rural areas) by 2015,

It includes

- A new revenue plan to pay for broadband networks which does not include raising taxes or state funds,

- A deployment and implementation plan to upgrade New York state, including regulatory, technology and implementation issues. This includes urban, rural and suburban areas including municipalities, with multiple technologies when needed.

- An economic development plan to create new “growth zones” and serve underserved areas.

- A) Does the proposal we are creating fit your guidelines or is your grant proposal only open to companies and groups who are looking for matching grants to roll out services?

CIO/OFT Response: From what you have stated above, your proposal could qualify to compete for these funds, but please be advised that the intent of the Grant Program is to provide state funding as a catalyst to encourage accessibility to and affordability of broadband services. There is a minimum $1 matching commitment by private or other governmental entities for each $1 of State grant funding applied for.

The grant states:

“A. $2,500,000 is available for distribution to facilitate increased physical access to broadband Internet services statewide. Such activities may include but shall not be limited to: research, design, implementation, operations, management and administration of programs related to infrastructure initiatives to facilitate physical access to communities and entities that lack such access.”

Our reading of this —we will provide research and implementation designs to create infrastructure initiatives as well as fund this implementation, thus provide access to customers who lack access, both short term as well as to create ubiquitous 100 mbps services.

Obviously, a successful plan to fund the state’s initiatives will also greatly help to make “available to provide equal and universal access to broadband Internet services for underserved rural and urban areas, including schools and libraries.”

- B) The state is requiring ‘matching’ funds.

The Grant:

“It is the intent of the State to seek public-private partnerships that maximize state-provided funding to the greatest extent possible with matched funds. While not mandated, the desired objective is a 4:1 match ratio, where the eligible applicant guarantees $4 will be provided for each $1 awarded by the State. Applicant commitments may be in the form of cash, in-kind goods and services or a combination of the two.”

As analysts, including experts, lawyers, et al, our matching funds will be in the form of in-kind work – i.e., work being done below normal costs, as well as marketing through our organization. Does that qualify as matching funds? Example, the ‘Broadband Opportunity plan’, part one, will be structured as a one time –report. The market value of this report is estimated $155,000 (or more as we close the details). OIA will perform this module for $40,000 thus the matching funds in-kind is 3 to 1. Other areas can have higher-ratio matching funds as many of the ‘experts’ will be working at a fraction of their normal per diem.

CIO/OFT Response: In-kind goods and services may include labor/professional services.

- C) OIA Requests an Extension of deadline

OIA believes that the time frame set can not be used by anyone who has to develop relationships to do matching grants from other sources. For example, approval of a grant by the state to match the research and implementation we are proposing by a 3rd party grant can not be done in a month.

It is clear that reading the other questions presented to date, we are not the only one who is questioning the State’s short timeframe.

CIO/OFT Response: While we sympathize with your request, our responsibility is to select winning grants and award contracts prior to the end of the State’s fiscal year on March 31, as such the deadline for submitting applications will not be extended.

- D) 5 Year Information.

Our proposal will call for one-time fees and ongoing fees on a ‘retainer’ basis or per diem. These expenses can not be ascertained until the acceptance of the one time report — i.e., we can not work on an implementation plan if the original report or the baselines outlined above have not been accomplished. We are assuming that the 5 year plan is based on provisioning of services and not research. We can project our costs associated with a retainer if “Part One” is done.

CIO/OFT Response: Your assumption is correct. The intent of the 5-year reporting requirement is to annually document and report increases in broadband availability, subscriber usage and other important demographics from current baselines.

- E) Modular Submission.

Based on the state’s response, we will be submitting this plan as a plan presented as a series of modules, including ‘surveys’, research, implementation, legal and regulatory, as well as economic development modules. Are there constraints to this approach as to how many modules we submit?

CIO/OFT Response: No…there is not.

Bruce Kushnick, Executive Director, New Networks Institute

Chairman, Teletruth

fixingtelecom

Fixing Telecommunications

We just released the first two reports in a new series, “Fixing Telecommunications”. It is based on mostly public, but unexamined, information that exposes one of the largest financial accounting scandals in American history. It impacts all wireline and wireless phone, broadband, Internet and even cable TV/video services, and it continues today with impunity.

Verizon, AT&T, CenturyLink, and other large telephone companies have been able to manipulate their financial accounting to make the local phone networks and service look unprofitable and have used this ‘fact’ in many public policy and regulatory decisions that benefited the incumbent telecommunications utilities.

American history. It impacts all wireline and wireless phone, broadband, Internet and even cable TV/video services, and it continues today with impunity.

-

Fact Sheet (1 page)

-

Short Summary (2+ pages)

-

FCC’s Big Freeze Timeline: 15 Years of Neglect “until comprehensive reform could be achieved”.

-

Report 1: Executive Summary– (10+ pager)

-

Report2: Data (40+)

Verizon, AT&T, CenturyLink, and other large telephone companies have been able to manipulate their financial accounting to make the local phone networks and service look unprofitable and have used this ‘fact’ in many public policy and regulatory decisions that benefited the incumbent telecommunications utilities.

In NY State, Verizon used this excuse to raise rates multiple times, stopped deploying and upgrading the fiber optic-based wired networks fiber and even stopped maintaining the copper networks with the plan to shut off the copper and force customers onto wireless. This has left most cities with deployment gaps or no upgrades at all.

Worse, it also impacts the price for wireless services, as almost all mobile data, video or calls end up riding over a wire, known as ‘special access’. These services are mostly controlled by Verizon, and in their own territories, AT&T and Centurylink (they do not compete among themselves for this business in any significant way).

Adding insult to injury, the losses were caused by the other Verizon lines of business dumping expenses into the state utility. Much of Verizon Wireless’s fiber wires to the cell towers were paid for by local phone customer rate increases.

Finally, this impacts every aspect of the FCC’s Internet Order, commonly known as Net Neutrality, which is now in court. The massive cross-subsidies between and among Verizon NY and Verizon’s other subsidies have allowed the company to control the networks and services over them, including blocking competition —which caused Net Neutrality concerns in the first place.

The FCC’s Big Freeze—15 Years of Regulatory Neglect:

While there are multiple questionable acts, at the core, the fact is that the losses were created, in part, by the FCC, which sets the rules about the incumbent phone companies’ accounting. Simply put, in 2001, the FCC “froze” the calculations of expenses that are used in every state, based on the year 2000 — and this freeze will continue until the year 2017. It assigns the majority of all expenses to the local phone service category. There have been no major audits or investigations by FCC nor the states for 15 years. This phrase has appeared, in one form or another, since 2000: “until comprehensive reform could be achieved”…

New Networks Institute Activities, 2013-2015

New Networks Institute & Teletruth Activities, 2013-2015

Net Neutrality and Verizon’s Use of Title II

- New Networks Institute’s (NNI) work in highlighted in the FCC’s Internet Order, and influenced some of new added safeguards pertaining to billing and disclosure issues, March 2015.

- NNI & Teletruth have filed a Petition for the FCC to investigate whether Verizon has committed perjury as Verizon has failed to disclose to the FCC, courts or public that their entire financial investments are based on Title II; filed January 13th, 2015.

- Ars Technica Featured article: FCC urged to investigate Verizon’s “two-faced” statements on utility rules

- Verizon has responded with a letter denying our claims, filed, January 20th, 2015

- New Networks Institute & Teletruth Response to Verizon, Feb 23rd, 2015

- Verizon: Show Us the Money PART I: Verizon’s FiOS, Fiber Optic Investments, and Title I. – Part 1 is a supplement to the original Petition for Investigation.

- Letter to the FCC, Comments: Open Internet proceeding. RE: Verizon’s Fiber Optic Networks are “Title II” — Here’s What the FCC Should Do. DOCKET: Open Internet Proceeding, (GN No.14-28)

- Comments First: FCC Open Internet Proceeding “Title Shopping: Solving Net Neutrality Requires Investigations” , July 14th, 2014

- Comment Second: Verizon’s FiOS Fiber to the Premise (FTTP) Networks are Already Title II in Massachusetts, Maryland, Florida, New Jersey, District of Columbia, Pennsylvania, New York…

Time Warner Cable- Comcast Merger; New Findings

- Comcast and Time Warner Cable Merger In 2015 we filed a Petition for Investigation and Complaint against Time Warner Cable with the NYPSC and FCC to stop the mergers for multiple reasons, from deceptive billing and made up fees, to overcharging via the “Social Contract”. The “Social Contract”, an actual agreement between the cable companies and the FCC, allowed the companies to charge the cable subscribers for network upgrades and the wiring of the schools. The Contract ended in 2001, however we could find no schools wired under this program, and no removal of the additional charge of $5.00 a month, which started in the 1990’s.

- Some of this material was quoted in Mayor DeBlasio’s comments pertaining to the TWC Comcast merger with the NY PSC.

- Ars Technica article: Petition: Time Warner Cable mistreats customers, shouldn’t merge with Comcast

Examining the Financial Shell Game

- In May 2014, Public Utility Law Project, (PULP) published “It’s all Interconnected”, written by New Networks (with assistance by David Bergmann) and it relied on unexamined data from Verizon New York using different Verizon supplied financials books.

- The Verge: Game of Phones: How Verizon is playing the FCC and its customers, May 2014

- In 2010, NNI started an investigation of the financial books of five Verizon’s state-based utility phone companies, including Verizon New York and Verizon New Jersey and the ties to Verizon Communications affiliate companies, (subsidiaries) including Verizon Wireless, Verizon Online, Verizon Services, among others.Published in 2012

- In 2013, our next report focused on Verizon New York and was the centerpiece of a filing by Common Cause, Consumer Union, CWA, and the Fire Island Association, which called for an investigation of Verizon’s financials and business practices.

- The Connect New York Coalition, filed a Petition with the New York State Public Service Commission to do a formal investigation of Verizon New York. July 1, 2014. The Petition is based, in part, on NNI’s continuing research.

- Coalition members include AARP, Consumer Union, Common Cause, CWA, and NY state politicians.

- Event “Reverse ALEC Legal Hackathon” Thursday, January 31st, 2013, Brooklyn Law Incubator and Policy Clinic (BLIP) and the New Networks Institute hosted a Reverse ALEC Legal Hackathon at Brooklyn Law School. The invitation-only event, something of an emergency meetup, brought together experts, lawyers, advocates, technologists and competitors, who are concerned with the state of telecommunications in the United States. The goal was to create consensus and build a campaign to define principles for model regulation, pursue legal actions, and create a working path to accomplish the following goals.

- New Book: The Book of Broken Promises: $400 Billion Broadband Scandal & Free the Net, Published New Networks Institute, February 2015.

legalhackers

We Solved Net Neutrality — Plan for Solving America’s Communications Issues.

Conclusion: Summary of the series based on the report “It’s All Interconnected”—and What Should America Do Next.

As we discussed in “Fast Lane, Slow Lane, No Lane, End Game in Communications”, Net Neutrality is really not the primary issue— it is a symptom of underlying problems that need to be solved.

Here is a summary what we found and then we will present a plan for solving Net Neutrality and America’s communications issues.

Backdrop:

In 1996, the Telecommunications Act was passed to open up the ‘last mile’, or first hundred feet, the wire to the customers home or office which would allow independent ISPs and competitive local exchange companies, CLECs to use the existing wires to offer competitive services.

In 2004, led by then chairman Michael Powell, (now head of the cable association, NCTA), the networks were closed to competition. This was accomplished by classifying broadband and internet as one service – an ‘information service’, (Title I) which did not have the obligations that a ‘telecommunication’ service has, (Title II). Prior to this, broadband was always a telecom service, and the networks had been ‘opened’

The FCC has tried multiple times to make the ‘internet’ open, by attempting to add ‘telecom-like’ obligations, and in 2014 Verizon won a legal challenge — claiming that the FCC Open Internet order should not stand — and that ‘reclassifying’ broadband as “Title II” harmed investment and innovation.

Smoking Gun: Verizon’s FiOS Fiber Optic Networks Are Already Based on Title II, since at least 2005.

We checked multiple municipalities, cities and even system-wide cable franchises and in every one Verizon has used the Title II classification for the deployment of its FTTP, Fiber-To-The-Premises’ networks.

2) Verizon claims that Reclassifying broadband Internet access service as a Title II …would only endanger the entire Internet ecosystem.”

And this is in direct contradiction to Verizon own statements that claims that it has invested billions in FiOS and that reclassification would be a major drag on broadband infrastructure deployment

- Verizon’s Open Internet Comments “Verizon has invested tens of billions of dollars to build our wired and wireless broadband networks, including more than $23 billion spent to construct our fiber-optic FiOS network since 2004, and we continue to expend large sums to improve and grow those networks.”

- Verizon’s blog “Reclassification would create a major drag on new and improved broadband infrastructure”,

If FiOS is already Title II, these statements contradict their own current deployments.

Searching Verizon’s filed FCC comments as well as examining the court documents and transcripts, we could find no mention of Verizon telling the FCC or court that the current networks use Title II for the deployment of their premier fiber optic networks.

We found “Title Shopping”, where Verizon uses different classifications for the same service to maximize regulatory benefits. But when compared, there are major legal questions that arise as it is not legal to charge local phone customers for the deployment of a cable service (Title VI) or for an information service, (“Title I”).

Did Verizon violate the law and regulations with its failure to disclose, at every turn, the company’s reliance on Title II for its broadband networks

Why Use Title II: Charge Basic Rate Phone Customers for the construction of the FTTP Networks and Rights of Way.

In New York State, Verizon was able to get multiple rate increases on “POTS”, (“Plain Old Telephone Service”) customers to fund a ‘massive deployment of fiber optics’ and because of substantial financial losses.

And Verizon had massive losses. From 2008-2012, Verizon New York lost $11 billion dollars, over $2 billion a year, which gave the parent company, Verizon Communications a $5 billion dollar ‘tax income benefit. And, Verizon paid no taxes and used the losses to raise rates.—I’ll return to this in a moment.

Verizon used Title II so that the FTTP networks would fall under the state laws as part of the utility network upgrades. Starting in 2006, customers paid an additional $500.00 per line through rate increases and additional taxes, fees and surcharges. Using Title II also gave Verizon the utility rights-of-way and all that is associated with that.

Verizon New York has stated it had completed its FiOS deployments in the state, and except for outstanding obligations, Verizon is leaving 80% of the municipalities without upgrades even though ALL POTS customers were hit with rate increases to fund the construction and deployment of the FTTP networks.

This is a double-whammy on low income families as they not only paid extra for services, but as many of the New York State mayors of major cities stated, low income areas were left out of the Verizon FiOS plan

Cross-Referencing Verizon’s Accounting Financials from Different Sources Revealed Black Hole Revenues and Construction Cost Issues.

6) Verizon New York’s Multiple Financial Books Reveal “Black Hole Revenues”.

The Verizon New York rate increases on basic rate customers were granted based on ‘massive deployment of fiber optics and extensive losses.

When we examined Verizon’s financial accounting, presented in their SEC filings and their state-based PSC filings for the year 2009 we found that the SEC filings had an additional $2.7 billion dollars as compared to the PSC annual report for the same year. And there was no information provided about these extra revenues — and we dubbed it ‘black hole’ revenues.

When we compared the construction budgets for these two financial books we found that they were identical, indicating that the black hole revenues paid no construction costs, at least that was in the Verizon New York books.

NOTE: The FCC’s data stopped in 2007 but the FCC never examined the total revenues for any state, but only presented the regulated books — the Verizon New York PSC books.

Verizon’s Affiliate Companies have Taken Control of the Wires

7) Verizon Phone Bill Quiz: You Won’t Get Any Answers Right.

8) How Verizon’s Affiliates Took over this Broadband, Internet and Phone Bill.

While most people think that ‘Verizon’ is the only company offering services on a double or triple play bill, truth is there are multiple affiliates and partners that offer service.

We created a short quiz for people to identify the four different affiliate companies and partners that were offering a customer services on their Verizon New York 1 line account.

Affiliates are Paying Incremental Costs—and Not the Building of the FTTP Networks.

The ‘regulated books’ in the Verizon New York Annual reports are based on the Uniform System of Accounts, (USOA) and so the conclusion by our experts is that the Verizon Online, Verizon Business, and other services, which are based on IP protocols or ‘information’ services are most likely in the ‘black hole revenues’. This indicates the broadband, Internet, cable and VOIP phone services are probably paying ‘incremental costs’ and not the costs of building the FTTP networks, which are Title II.

And this, in part, created the losses in the state utility, that was used for rate increases.

The Secret Second Network: Special Access and the Wireless-Wired Ties.

There are two classes of service;

- Retail services to residential and business customers, which we’ve seen has a bottleneck created by the vertical integration of phone, broadband, internet and cable over 1 wire.

- Special Access, also called backhaul or middle mile, which are the wires in the middle of the networks and can be data services as well as competitor services. Sprint and T-Mobile pay AT&T and Verizon for these networks as they have monopolies on their incumbent wires. They are also part of ‘interconnection’ and peering –networks that content providers like Netflix use with an “ISP”,

And Special Access services are “secret” because the FCC stopped providing any data in 2007.

We found that there are special access services (using Title II) in the regulated PSC books that are now larger in revenue than local service. However, local service paid a disproportionate amount for ‘plant specific’ expenses as compared to access services in general.

But the kicker is that the “IP based and fiber optic based special access services appear to be in the ‘black hole’.

Using Verizon New York, we estimate that the total revenues was almost $30 billion in 2013, while the black hole revenues are probably as large, bringing the total US market to almost $60 billion. (Other analysts claim the market is just $12-$15 billion, but they rely only on previous FCC data.)

Verizon Wireless and Wireline Ties

Verizon Wireless appears to have the expenses for the special access wires to the cell towers paid for by the wireline construction budgets, i.e., Title II local service. At the same time, Verizon Wireless appears to be paying a fraction of what the competitors are paying.

Moreover, when Verizon and AT&T state that they are ‘shutting off the copper’ in areas, they aren’t shutting off these customer-funded wires dedicated to wireless and since these wires are monopoly products and are used by the wireless competitors, Verizon makes money on all wireless calls.

Net Neutrality Solved —a Plan for Solving America’s Communications Issues.

“Fast Lane, Slow Lane, No Lane, End Game in Communications”. These are the some of the issues that are currently facing America’s communication customers and competitors.

Net Neutrality is caused by a bottleneck where the cable, phone, broadband and Internet services provided over 1 wire are controlled by 1 company and the affiliates also get major advantages, placing competitors at a disadvantage. It also gives controls of tied-products so that the ISP and broadband, together can slow down a service or block or degrade a service. And it controls the price, quality and speed of service.

But controls over the wire also give the company controls over who gets upgraded and who doesn’t, who will shut off and who will end up in a ‘Digital Dead Zone.

Time for a change.

What the FCC, Courts, States Commission need to do:

We will focus on Verizon as it was the company that took the FCC to court.

STEP 1: The FCC must Acknowledge that Verizon’s FTTP networks are already Title II and Investigate the Implications.

We are almost speechless when we see that Verizon’s entire FTTP networks are already using Title II and that Verizon never disclosed this fact to either FCC or the courts—or that the FCC never found and questioned Verizon about this.

Simply put: The FCC must:

- Acknowledge that Verizon’s entire fiber optic networks are Title II already.

- Investigate Verizon’s current use of Title II and whether Verizon’s failure to disclose this fact violated laws or ethics to the FCC or the court.

- With the States jointly work to examine “Title Shopping”—gaming the regulatory system.

- There is no need for reclassification—Verizon’s networks are already Title II.

STEP 2: The FCC and the States Needs to Investigate how Title II Was Used to Make Regular Phone Customers ‘Defacto Investors’ of the FTTP Networks.

In New York, Verizon was able to get rate increases of POTS, plain old telephone service, customers to fund these networks. This includes low income families, small businesses, municipalities, and anyone still using the copper networks.

What the FCC and States need to do:

- The FCC must examine the fact that basic rate phone customers have been the defacto investors of Verizon’s fiber optic networks.

- States need to examine the rate increases in light of funding FiOS and the FTTP networks, where they may never benefit.

STEP 3: Follow the Money and the Controls: The FCC Must Examine The Affiliate Companies Control Over the Wire and the Flows of Money.

On July 1st, 2014, a newly formed group “Connect New York Coalition” filed a petition with the NY State Public Service Commission to investigate the telecommunications companies in New York State – including Verizon.Read the Petition, Coalition members

Consisting of AARP, Consumer Union, Communications Workers of America, Common Cause, among others, the Petition is based, in part on the PULP-New Networks report (the basis of this series) and New Networks previous report.

This investigation requests include

- Did the affiliate companies to put expenses into the state-based utility that caused losses.

- Were wired construction budgets diverted to fund wireless instead of properly upgrading and maintaining the state infrastructure.

What the FCC Must Do:

- Start an investigation into the flows of money between the state-based utility (and title II), and the affiliate companies

- A specific investigation needs to be done of the wireless and wired-businesses relationships.

- Do a specific investigation of the ‘special access’ revenues, expenses, the use of the Title II classification and the ties to the state utility networks.

Step 4: The FCC Needs To Get Serious About Data and Analysis—Finally.

The Companies hide most of this behavior because the regulators stopped collecting data.

- Verizon stopped publishing the SEC-filed state-based financials in 2010. Moreover, AT&T hasn’t filed separate SEC reports for at least a decade.

- The FCC abolished the data collection in 2007 of the “Statistics of Common Carriers” and the FCC has never collected the ‘black hole’ revenues that appeared in the SEC filed reports for any state, much less Verizon New York.

- The New York PSC reinstated the filing of Annual report financials in 2009 but no other state commission, has anything resembling this level of detail.

And even the New York PSC data is still missing basic data. A simple example — we do not know the actual number of “total lines in service” by Verizon New York or the affiliates, nor how many are copper or fiber.

The FCC needs to

- Re-establish data collection that includes the information supplied by the FCC’s ARMIS and Statistics of Common Carriers.

- examine the separate subsidiary rules and data collection, that were

STEP 6: FIX Communications: Open the Networks, Separate the affiliates, and Move Towards Open, Universal Fiber Utilities.

After all the data is collected, so that the FCC and states have a clear picture of the last decade of business practices by the incumbent phone companies and their affiliates, we believe that the only logical steps:

- Open the Networks to All forms of Competition

- Reestablish the wholesale use of the networks

- Separate the affiliates from the controls of the wires

- Make the affiliates pay market prices.

- Return the customer-funded assets to the state-based utility

- separate the wireless company from the wired company

The Economics of Title II:

If the affiliate companies paid their fair share, stopped dumping affiliate expenses into the state utility, and returned the customer-funded assets, such as special access, the state utilities could deploy fiber optics to all homes and premises.

Today, the construction budgets were diverted to not build out the networks, to build out the wireless business, and the affiliate excess caused a large part of the losses.

While Verizon will claim all of this is a ‘takings’, it is — a takings from customers who have become defacto investors in the creation and expanse of the affiliate businesses.

As we started, FiOS is Title II, common carriage and was funded via rate increases based on ‘massive deployment of fiber optics’. If Customers paid for it, and it is Title II, they are entitled to upgrades—everywhere in the franchise area.

Cities and States must also start this process as it is clear that there has been regulatory neglect to the point of severe harms.

- Getting Cities and States Wired

- Getting Rural Areas Wired